Gross pay to hourly calculator

The resulting total provides you with your exact gross pay or a gross pay estimate when using approximated values for a job offer. For instance for Hourly Rate 2600 the Premium Rate at Time and One.

Annual Income Calculator

Calculations have been updated to reflect the additional 202223 National Insurance contributions and changes in Pension contributions from October.

. While in case of the second tab called Hourly wage the equations used are-IF the hourly option is checked THEN. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering Irish income tax Universal Social Charge and Pay-Related Social Insurance. For premium rate Time and One-Half multiply your hourly rate by 15.

This calculator is based on 2022 Ontario taxes. Switch to Maryland salary calculator. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

For example if you earn 2000week your annual. You can use our simple calculator below to quickly calculate retroactive pay for hourly employees salaried employees and even for flat rate amounts. Net annual salary Weeks of work per year Net weekly income.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Find the page to which you want to. The latest budget information from January is used to show you exactly what you need to know.

This number is the gross pay per pay period. It determines the amount of gross wages before taxes and deductions that are withheld given a specific. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Input additional payments like overtime bonuses or commissions. Whether the employee receives a weekly bi-weekly or monthly paycheck this calculator is simple to use. Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator.

A Hourly wage is the value the user inputs within the 1 st field WL. Your gross pay is equal to the total value of your base pay overtime pay bonuses and benefits. This Maryland hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Fit Small Business does not provide legal or tax advice. Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE. Then enter the number of hours worked and the employees hourly rate.

Hourly Rate Bi-Weekly Gross HoursYear Calculating Premium Rates. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. Depending on the information you provide the Pay Rate Calculator computes different information.

Adding Monthly Salary To Hourly Salary Calculator pay Calculator to your Wordpres website is fast and easy. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Other gross pay contributors.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Gross annual income - Taxes - CPP - EI Net annual salary. Keep in mind that the calculator cannot calculate payroll with the impact of overtime in prior pay periods.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. Then use the employees Form W-4 to fill in their state and.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The PaycheckCity salary calculator will do the calculating for you. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Switch to Oklahoma salary calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Please note that these calculations are based on the 202223 NHS payrise announced in July 2022.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Fill the weeks and hours sections as desired to get your personnal net income. Net salary calculator from annual gross income in Ontario 2022.

Gross pay and pay frequency. It is a reflection of the total amount your employer pays you based on your agreed-upon salary or hourly wage. Switch to Missouri salary calculator.

Start by subtracting any pre-tax deductions offered by the business. To try it out enter the workers details in the payroll calculator and select the hourly pay rate option. Gross salary is a basic salary that an employee receives while working for an employer.

Net weekly income Hours of work per week Net hourly wage. This powerful tool can account for up to six different hourly rates and works. Start with the employees gross pay.

How to Calculate Hourly Pay. Your gross pay will often appear as the highest number you see on your pay statement. Your actual take-home pay will be lower than the hourly or annual wage listed on your job contract.

In this case well use the hourly employee from Table 1 whose gross pay for the week was 695. Switch to Kansas salary calculator. Net salary is a portion of the Gross salary that is derived after deducting various expenses and deductions.

NHS Hourly Pay 202223 including NI The table below lists the NHS Band salary gross and net hourly rates amount per hour. Be sure to confirm. Hourly rates and weekly payscales are also catered for.

Skip To The Main Content. For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay. If this employee had zero deductions their gross pay and net pay would be the same.

Allowances and withholding information. The reason for this discrepancy between your salary and your take. This Kansas hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Until 1984 an hourly rate of basic pay was computed by dividing the employees annual rate of basic pay by 2080 hours the number of hours in 52 workweeks of 40 hours and rounding to the nearest cent. This is where the deductions begin. This Oklahoma hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Employees receive overtime pay. An employee who wants to make sure that he or she receives the right gross earnings on paychecks can take advantage of using an online hourly rate calculator. Dont want to calculate this by hand.

Get 247 customer support help when you place a homework help service order with us. The hourly rate calculator has an option that. -Double time gross pay No.

Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2022. Of double hours Double rate per hour-Total gross pay Regular gross pay Overtime gross pay Double time gross pay.

Use this federal gross pay calculator to gross up wages based on net pay. For a regular full-time employee the hourly rate was then multiplied by 80 to determine the biweekly gross pay. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques.

Hourly Paycheck Calculator quickly generates hourly net pay also called take-home pay free for every pay period for hourly employees.

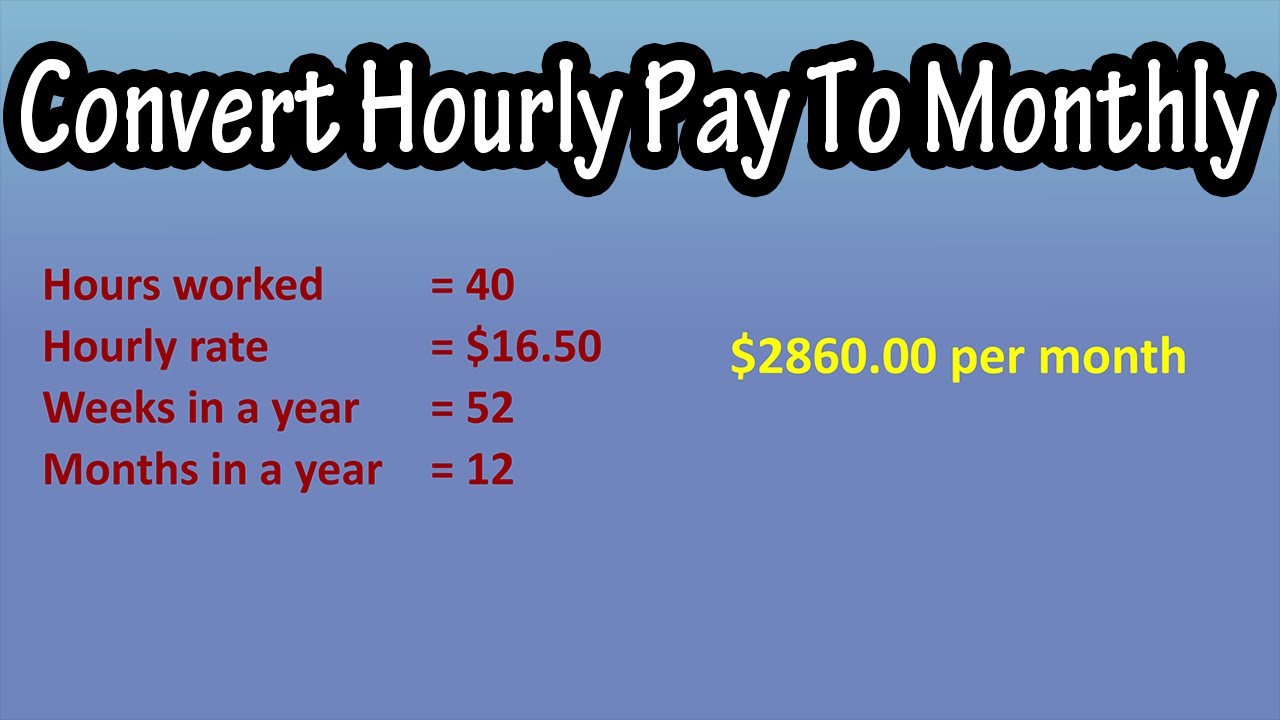

How To Calculate Convert Monthly Salary Earnings Pay From Hourly Pay Rate Formula Monthly Pay Youtube

Hourly To Salary What Is My Annual Income

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

3 Ways To Calculate Your Hourly Rate Wikihow

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Annual Income Calculator

Avanti Gross Salary Calculator

What Is Gross Pay Definition Examples Calculation

Gross Pay Definition What It Is How To Calculate It Sage Advice Us

Salary Calculator

Hourly To Annual Salary Calculator How Much Do I Make A Year

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

How To Calculate Payroll For Hourly Employees Sling

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Salary To Hourly Salary Converter Salary Hour Calculators